When it comes to a typical Filipino family set up, mothers are the ones who handle the family’s finances. They have always taken the general role of managing the monthly income and directing their family’s budget to the necessities that can keep the family fully functional. While they are inherently experts when it comes to money matters, mommies can still improve their magical methods in taking care of family finances. Here are a few tips on how you can supercharge your financial mommy powers.

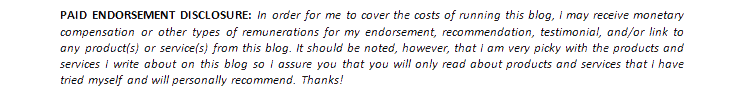

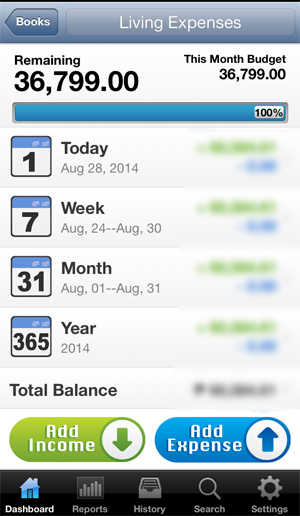

Create a clear overview of your monthly budget

Drumming up yourself to save more for your family is easy, but the actual process is harder than it seems. For mommies to know where to start with their quest in keeping the expenses as low as possible, they need a roadmap of all the expenses that come in and out of the house. This means combing through credit card bills, grocery receipts, and other items that will allow you to track expenses. This may be a daunting task, but by having a clear picture of your monthly overhead, it is easier to weed out unnecessary expenses or keep your bills at a minimum.

Drumming up yourself to save more for your family is easy, but the actual process is harder than it seems. For mommies to know where to start with their quest in keeping the expenses as low as possible, they need a roadmap of all the expenses that come in and out of the house. This means combing through credit card bills, grocery receipts, and other items that will allow you to track expenses. This may be a daunting task, but by having a clear picture of your monthly overhead, it is easier to weed out unnecessary expenses or keep your bills at a minimum.

Make the switch when it comes to grocery shopping

When it comes to grocery shopping, there are many ways mommies can save. However, one of the biggest culprits why grocery bills eat a huge chunk in your monthly budget is because of your brand preference. Sometimes, the major difference between two brands is simply the label, and you can save more in the long run by making the switch. For common household items such as sugar and salt, consider shifting down from your regular brand to store-owned brands. Meanwhile, you’re better off with generic brands of home cleaning products such as dishwashing liquid and toilet cleaner since they are consumables and they do the same job as your usual brands. While it is a good idea to make the switch, keep in mind that you should only settle for the cheaper ones when the quality isn’t compromised.

Prepare for the worst possible moment

For mommies who handle the budget of the family, the worst possible moment may be the time when the bread winner of the family gets the boot at work. If this happens, it means there will be no resources to allocate, and this spells doom to the entire family. As part of a contingency plan, all moms should prepare for the worst possible scenario: unemployment. To prepare for possible unemployment, simply save up a portion of your monthly savings. Some people recommend saving up to six months’ worth of expenses since this is the average duration for people to switch from one job to next. While your mileage may vary, just make sure that you have the resources to use in case someone gets the pink slip.

Try to earn money on the side

In this day and age, the adage “fortune favors the bold” still holds true, and this does not happen to moms who are simply idling and waiting for the monthly budget to come to their hands. Fortunately, there are many ways moms can get themselves occupied, and these activities can even allow them to earn a little on the side. Baking, online selling, preparing daily meals, and other jobs that require only internet connection to have a wide reach are just some of the things stay-at-home moms can do. Imagination is your limit when it comes to these jobs. However, do not let these part-time activities hinder you from doing your real job.

In this day and age, the adage “fortune favors the bold” still holds true, and this does not happen to moms who are simply idling and waiting for the monthly budget to come to their hands. Fortunately, there are many ways moms can get themselves occupied, and these activities can even allow them to earn a little on the side. Baking, online selling, preparing daily meals, and other jobs that require only internet connection to have a wide reach are just some of the things stay-at-home moms can do. Imagination is your limit when it comes to these jobs. However, do not let these part-time activities hinder you from doing your real job.

Cook delicious and nutritious meals

While some moms are savvy when it comes to turning ingredients to a sumptuous meal, there are others who didn’t have the chance to study the basics of cooking. For moms who don’t know how to cook, there are dozens of resources online that will allow you to learn cooking from scratch. Cooking blogs, YouTube channels, and other articles are there to help you get your culinary skills become as sharp as a chef’s knife. After all, cooking a delicious meal is way better than store-bought meals, and they are cheaper too.

While some moms are savvy when it comes to turning ingredients to a sumptuous meal, there are others who didn’t have the chance to study the basics of cooking. For moms who don’t know how to cook, there are dozens of resources online that will allow you to learn cooking from scratch. Cooking blogs, YouTube channels, and other articles are there to help you get your culinary skills become as sharp as a chef’s knife. After all, cooking a delicious meal is way better than store-bought meals, and they are cheaper too.

While it is important to have enough budget to make sure that all of your expenses will be covered, keep in mind that proper allocation of money will keep the family’s financial matters intact. And who are better suited to the role than mommies?

eCompareMo provides a complete comparison portal for Filipinos looking for quick, secure, and complete banking and insurance information in the Philippines. For more information about their product or service you might want to check out their website at www.ecomparemo.com.

Very nice article! Every filipino mom could relate and it could really help them manage their family’s finances too. Thanks for sharing!

Thank you, Jean. I’m glad you found this helpful. 🙂