I have been in business for five years and in all those years, I would line up for at least half a day at the bank to pay my taxes. It’s the worst part of being in business, to be honest. I mean, I love working on my business, but I hate that I have to spend so much time just to pay my taxes. It’s precious time wasted, to be honest. And, not to mention, unnecessary stress to moms like me who usually bring my kids with me on errands. Thankfully, there are now apps like GCASH. It’s been around for a while, but I never thought it has the option to let its users pay BIR using the GCASH app.

You guys, this is a game-changer. You just need to file your taxes via the eBIR platform then head over to the app to pay. With just a few taps, you’re done! No more lining up for hours!

Before anything else, here are some things to take note of when You pay BIR via GCash:

- Form Series – You can the correct form series through the dropdown in GCash. If you are not sure which one to pick, click here to check my list of Form Series, Form Numbers, and Tax Types.

- Return Period – This is the last day of your return period. For example, if you are paying for your the quarter covering April to June, you will add June 30 in your return period.

- Branch Code – What is the branch code that GCash is asking for? These are the numbers that come after your 9-digit TIN. For example, if your TIN says 123-456-789-000, your TIN is 123456789 and your branch code is 000. Having three zeroes means you are an individual (not a business with branches). GCash requires five digits for the branch code. So if you have three zeroes, just add 00000 there.

- To use this method, you must file your taxes first via the e-filing.

- It is recommended that you only use this method if you are paying for taxes no more than P10,000. For payments above this amount, I pay via a BIR-accredited bank. If paying by bank, bring three copies of your printed and filled out form together with the email confirmation you received from BIR after you filled out the form.

- It is important to keep all records of your payment by taking screenshots of your GCash confirmation screen and saving the confirmation email (just in case). I also print out the documents for safekeeping.

- Do you have specific tax-related questions? You can contact BIR via contact_us@bir.gov.ph. I’ve done this a couple of times and they are responsive.

How To Pay Your Taxes Using GCash

Note: This is a step by step guide on how I pay BIR using GCash. Please note that you can only do this for taxes that have not passed their due date. If your tax is past due, please go to the nearest BIR branch with your filled out form to get a recomputed tax due. A penalty fee will be added for taxes that are not filed and paid before the due date.

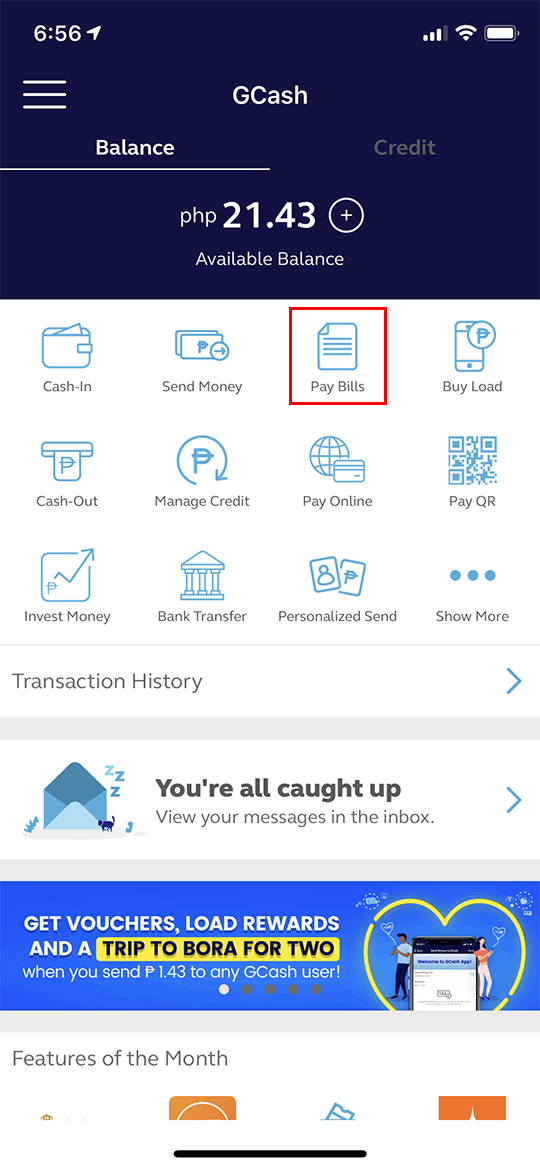

Step 1: Open the GCash app then select Pay Bills.

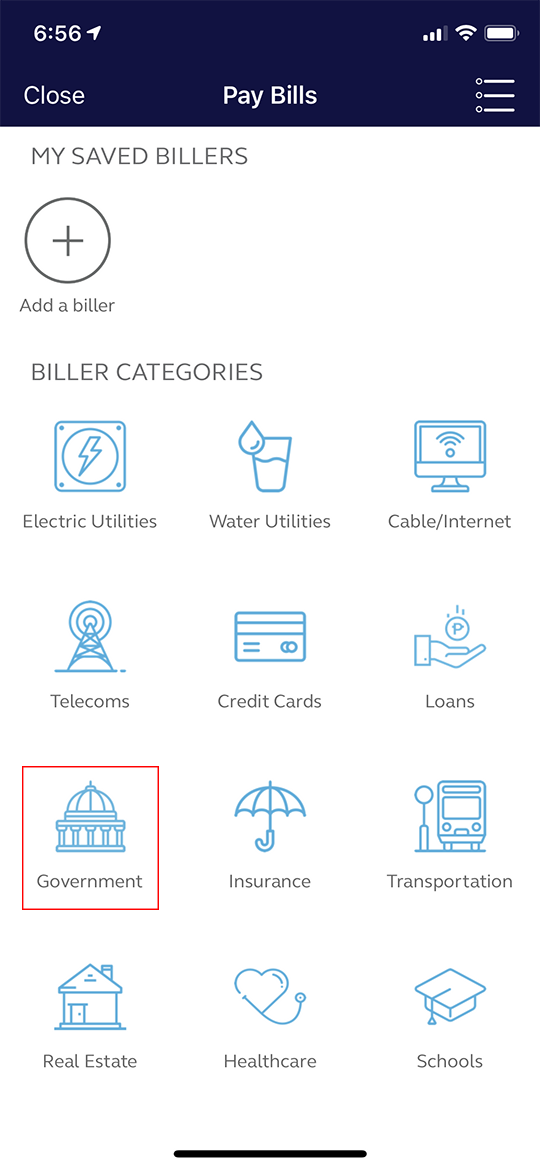

Step 2: From the options, select Government.

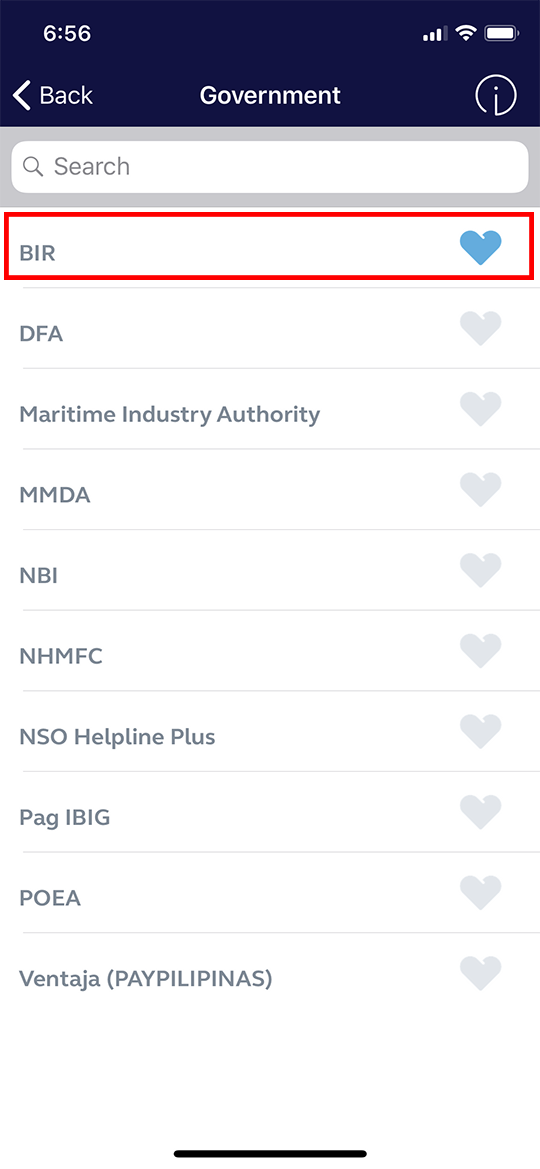

Step 3: From the list, select BIR.

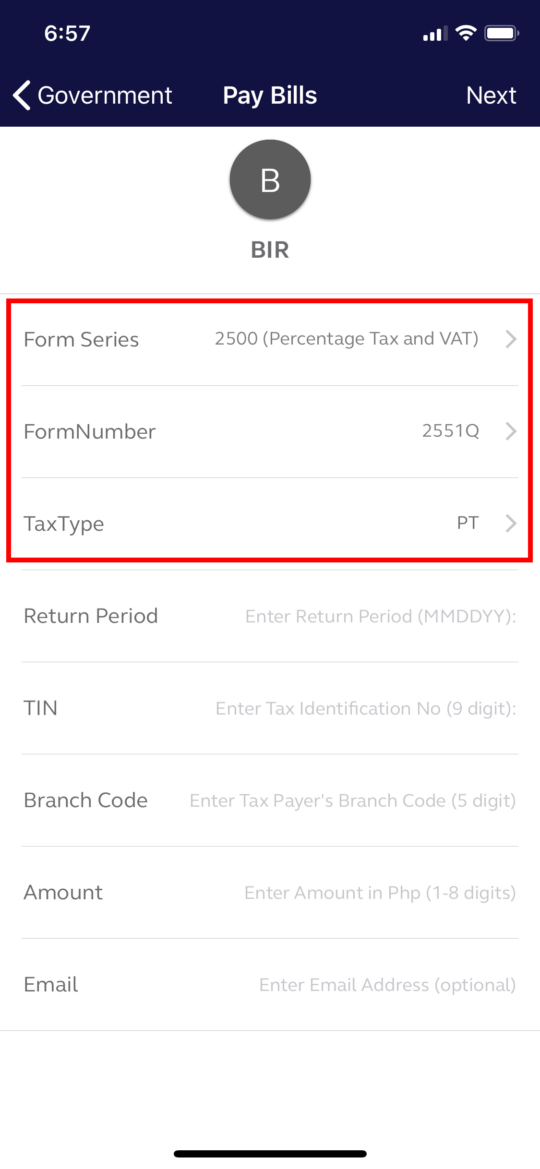

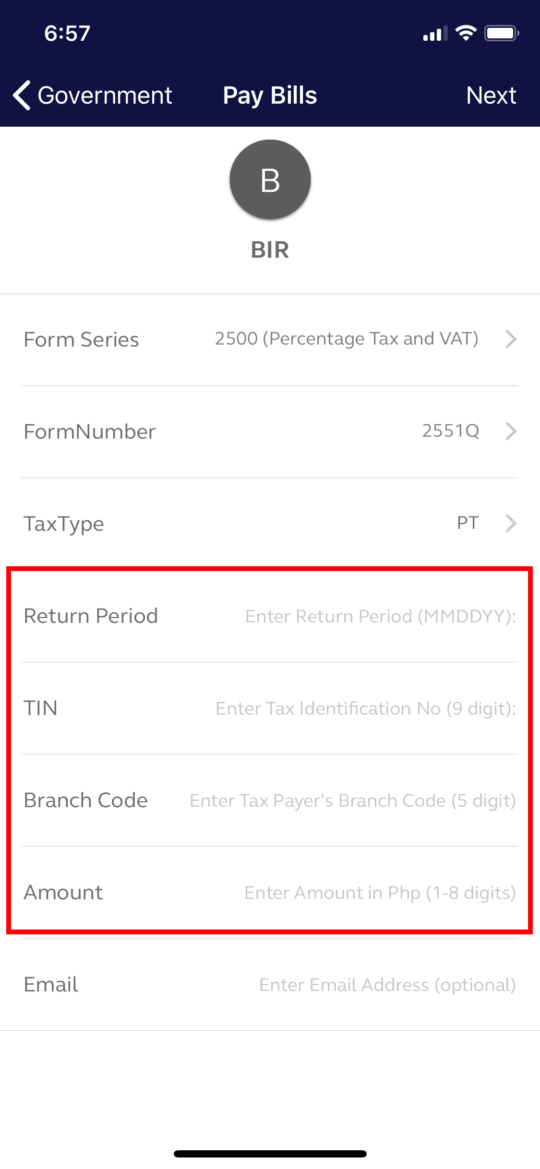

Step 4: Under the Form Series selection, choose 2500 (Percentage Tax and VAT) if you’re going to pay for the quarterly Percentage Tax. Under Form Number, select 2551Q. Under Tax Type, select PT.

Of course, your selection will depend on what tax you’re paying. Click here to find the list of form series and form types.

Step 5: In the Return Period, select the last day of the quarter for which you’re paying for. For example, if you’re paying for the October-December 2018 return period, select December 31, 2018.

Step 6: Enter your TIN, Branch Code (just put 00000 if you don’t have any other branches), and the Amount.

If you want to receive a confirmation e-mail, add your e-mail address as well. I recommend that you do this so you have a record stored in your e-mail. You can also print that out if you wish.

Step 7: Confirm your payment. You will be directed to a payment confirmation page and receive a text message confirming your payment. I recommend taking a screenshot of the page and keeping the text message. These will serve as proof just in case BIR checks if you really paid your taxes.

That’s it! You successfully paid your tax through the GCash app and you saved yourself from hours of lining up at the bank.

If you still don’t have it, download the GCash App here. Aside from paying taxes, you can use it to pay your bills and use it as payment for your groceries, eat outs, and more.

IMPORTANT: Please pay BIR via GCash before your tax due date to prevent any penalties. For taxes that are past due, you will need to go to BIR first for a new computation (tax due + penalty). To avoid extra charges, make sure you are on schedule. Click here to view our tax schedules.

Paano kapag 001 yung huling number sa TIN? 00001 ba ang branch code na ilalagay ko?

Hi Ms. Kimberly,

Is EFPS Allowed to pay thru GCASH ? or only on accredited banks connected in our EFPS account? Thank you

I believe you can pay through GCash.

Pwede po ba sa Gcash magbayad ng BIR Penalties na 1k Ma’am?

Ang alam ko pag penalty sa bank yan. Pupunta ka muna sa BIR para pacompute yung penalty mo then papakita mo yung paper sa bank for payment.

hi po paano po kung nagkamali ako sa branch code sa mga nabayaran sa bir.ano po dapat ko gawin.please help

Please reach out to BIR.

If today is the due date and I pay today will I be late payment already?

Hi Ra, I would suggest that you keep a receipt so if BIR checks, you can show them that you paid on time.

Hello, Is Branch code different from RDO code? And thank you for the useful tip! 🙂

Yes, those are two different things. Welcome!

nagkamali po ako sa Return Period. Imbes na Dec 31 2019, ang nailagay ko is current date. ma cecredit po kaya yun para sa 1700 na tax for 2019 ? At may way po ba para macheck sa BIR kung successful na nabayaran? Salamat po

For this, you might want to reach out to BIR. You can reach them via email.

hi ask ko lang after payment yun na yung proof of payment yung marereceived na confirmatuon from BIR? wala na bang isesend sa BIR na mga attachment? and if due date today can i pay Gcash today also?thank you in advance

Hi Mai. Yes, the confirmation email is the only confirmation you’ll receive. I’ve never paid via GCash on the due date. Normally, I pay before the due date. Usually kasi, may delays yan kaya to be sure, pay before the due.

posible po ba na magka penalty pag sa due date nagfile thru ebir then nagbayad ng due thru gcash?

I honestly don’t know po. It’s best to check directly with BIR so you know where you stand in terms of taxes due.

Hi Ms. Kimberly! Just wanna ask if after magbayad sa Gcash for 1700 payment, do we still need to go to BIR to submit the efile forms we printed? Thanks in advance!

No need. As long as it was filed via eFiling. Just make sure you have copies of confirmation emails and receipts.

Hello po Ma’am,

In form 1700, pano po malaman kung may babayaran o wala? First time ko po kasi mag fill-out. Thank you in Advance.

Ang alam ko po if you use e-filing, it will automatically compute so malalaman mo kung meron kang babayaran. Please note po na ang deadline ng Form 1700 ay April 15. You cannot pay late taxes via BIR. Click here for more information.

Tanong ko lang po after ko po mag file sa eBIRforms may nareceive po akong email from BIR, subject Tax Return Receipt Confirmation pero po walang xml file na kasama.

That’s the confirmation na po. What I do is I print it and put it together with the form it’s associated with so I have a copy of the filled out form and the email confirmation.

What should i put the return period for 1702 RT in Gcash?

Last day of the return period.

Hi there. Do we need to submit to the BIR office the printed copies of the 1702RT and the email confirmation together with the printed gcash receipt?

If it was done via e-filing, there is no need to bring it to BIR. Just make sure you have all those copies on hand in case there’s a dispute.

Thankyou mommy sa tutorial new user plng kasi ko nggcash salamat malaking tulong PO Ito

You’re welcome! 🙂

Thank you Ms.Kim for sharing this very informative info.Very convenient and hassle free na talaga pag may Gcash.

Yes 🙂 And you’re welcome!

If we submit eBIR, can we go to bank to pay for it personally? There is a payment section in eBIR but grayed out so I cannot edit. I believe that section should indicate if you plan to personally go to the bank to pay. I think that is part VI of the eBIR form. I am planning to go to the bank to pay since you have recommended to use GCASH only for taxes no more than 10K. Thank you.

You can bring it to the bank. Just bring 3 copies of your form.

Is it okay to use GCASH if my tax exceeds to 10k? Like example 10,090? Thanks!

It’s up to you po. Personal preference ko lang na anything exceeding 10k, I pay via bank na.

Hi, my name is jen, first time ko po magbayad thru Gcash, 200OT yong computation is galing sa BIR at verified nila, due date noong April 5, 2020 kaso hindi nakapgbayad sa bank dahil sa lockdown,, do i need to file it again sa ebir before paying it thru Gcash,? salamat

Hi Jen. Pag ganyang delayed, you need to go to BIR (doon sa branch mo). Kasi irerecompute nila yan for penalties. So don’t settle via Gcash since past the due date na.

Hello Ma’am,

I paid to BIR a while ago kaso walang receipt na binigay after maprocess young payment, Sa previous transaction, may narecieve naman po ako.

What are the other accepted proof of payments in this case Maam?

You paid via GCash? If so, there should be a confirmation e-mail.

Hi! What if I put the wrong branch code? Instead of ‘00000’, I put ‘00082’, upon payment. And I already confirmed my payment. What should I do?

Hello Lybel. I’m sorry, but I don’t know what to do when that happens. The best you can do now is to reach out to GCash Customer Support and BIR to get advice.

Thank you!

Hi Miss Kim,

Good day. Thank you for the very informative post. I just have a few questions.

I am filling up form 1700 through eFPS. On Part IV – Details of Payment, can I confirm that I will not put anything in here? And it seems disabled also. Since I have not yet paid yet, right? So I just have to leave it blank?

Does it mean that I have to file/submit the 1700 through eFPS first before paying through GCash? So after payment, the email from gcash/confirmation/receipt should be enough as evidence of payment and I do not need to fill up the payment details anymore from my 1700, right?

Lastly, my tax due is more than 50,000 pesos. Is that okay? Since you advised that this is only recommended for tax below 10,000 pesos? But it seems that this is my only option now since we are under quarantine.

Thank you so much!

*New form 1700v2018

Hi Shawn,

1. eFPS question – Unfortunately, I can’t answer that since I have an accountant who files for me. If you’re unsure, you can always reach out to BIR via email. They are very responsive.

2. Do you need to file through eFPS first before paying through GCash? YES! You need to file first, then pay. I keep all my GCash receipts, just in case.

3. To be safe, I pay for taxes over P10,000 through accredited banks.

Thank you so much for being so responsive and for your advise. For the accredited bank, can I pay it online (ex. Bpi) or I need to physically go to the bank?

Hi Shawn. I haven’t tried online payment via BPI for my taxes. What I usually do is I go to the bank with my printed docs.

Hi! What if I put the wrong branch code? Instead of ‘00000’, I put ‘00082’, upon payment. And I already confirmed my payment. What should I do?

It’s my first time. I filled out my BIR 2551Q for the Quarterly Percentage Tax Return manually since my computer isn’t compatible with the eFPS. I will pay thru gcash. So meaning, after the lockdown, I need to submit the papers plus the Confirmation from Gcash sa BIR right?

Good evening. I’m not sure if this is allowed. What I know is, you have to file via eFPS. Otherwise, your return won’t be recorded because it wasn’t really submitted to BIR yet (no stamps). My suggestion is to email BIR (look for their contact details in their website) and confirm this with them.

This is the first time that I’d be using Gcash/Paymaya for tax payment. If you’re not on eFPS, you may use eBIRForms. After validating and saving, click Submit/Final Copy.

From https://www.paymaya.com/support/bills-pay/bir

Please refer to the tax calendar and the latest issuances on tax filing and payment at the BIR website (www.bir.gov.ph). For ease of filing, you can file thru BIR’s Electronic Filing and Payment System (eFPS) or eBIRForms Offline Package.

Hello po Ma’am first time ko po mag pay via gcash binasa ko po lahat ng comments and response niyo but lito pa rin ako about branch code, Ang RDO ko po is 057, do I still input sa branch code is “00000”?

Thanks po God Bless.

Magkaiba po ang RDO at branch code. Kung ang RDO mo ay 057, then 057 ang ilalagay mo.

Kung walang other branches ang business mo, ang ilalagay mo ay 00000. Pero kung may branch, look for your specific branch code sa registration papers mo.

Hope that helps!

Thanks a lot po sa reply pero noon pong input ko yung 057 hindi sya nag proceed dapat daw 5 digit ang ilalagay sa branch code.. Halimbawa kaya ilagay ko “00000” hindi kaya ako magka problema sa BIR, makita kaya nila na nagbayad ako sa BIR.

Thanks po.

Hindi po. Ang 057 po ay RDO niyo. Kung wala kang branch, ang ilalagay mo sa Branch Code na field ay 00000.

And be sure po that you filed it online before you pay sa Gcash.

Yes po ma’am I filed it online, Thanks po.

God bless.

You’re welcome!

Good Morning, Our company is a non-eFPS filer and is using BIR Offline forms for bank payment. Do we need to apply BIR EFPS to pay using Gcash? Please send me a reply thru email. Thank you

Hello Seb. I have always used eFPS so I’m not sure. Sorry.

hi, wala charge from GCash (convenience fee, processing fee, whatever) when paying to BIR?

Based on my past transactions, no charge pa.

hi maam , ano pong form series ang 2550m, 0619-E, 1601C,1601EQ,1701Q,1702Q,1701, 1702

THANK YOU PO

Nandito po ang list ng form series and types:

http://www.momonduty.com/gcash-bir-form-series/

how about kung ang adress ko ay rdo 33. do i need to pay my tax using g cash on that area only. can i pay may tax anywhere fo example nasa malabon ako. pwede ko b sya ibayad sa malabon

Yes, I believe you can do that.

Hi po, this is my first na magpay po ako sa ng annual income tax return ko thru Gcash. nakapag gawa nako eBIRforms ng 1700 and received email also from bir so ang need ko nalang is payment. dun sa return date ano pa dapat ilagay or ano dapat consider na date? I’m paying for ITR year 2019.

Hope for your reply!

Thank you!

Return date is the last day of the period covered. In your case, December 31, 2019.

I submitted 1700 online thru eBIRFORMS, I received an email with xml filename. Pwede na ba mag proceed to payment? Or may steps ba ko naoverlook?

Yes, that’s it. Ang subject ng email confirmation nila is Tax Return Receipt Confirmation.

Hi Mel,

Can you share me the steps you did for filing using ebirform up to gcash payment? Successful ba sya? Hesitant ako sa gcash from ebirform filing.

I’ve been paying via Gcash. Ok naman. Just make sure you file first then pay.

Hi! If paying annual income tax through GCash, required pa ba pumuta sa BIR? Or okay na if nag-file na via eBIRforms?

Before you pay taxes via GCash, kailangan naka-file talaga via eBIRforms.

Personally though, dahil malaking payment ang annual itr, I file via eBIRforms then pay through an accredited bank.

What form will i use for 0619E ? When paying thru g cash?

In the Form Series, pick 0600 (Payment Form). Then in the Form Number, pick 0619E.

Hi, thank you for your post!

Pano nyo po nacoconfirm that you are paid already sa BIR? Nagsesend ba si BIR ng confirmation email? Thanks!

Si Gcash ang nagsesend ng confirmation e-mail. I reached out to BIR about this. Ang sabi nila sa akin, keep your records. So, print the confirmation e-mail from BIR that shows that you filed your tax, then print the e-mail confirmation from GCash that shows that you paid for it. This way, you have proof that payment has been made in case they ask you.

Hello Mam. After I have paid thru GCash, do I still have to submit printed copies of the BIR Form 0605, the email confirmation of BIR, and the payment receipt from GCash, to the BIR office?

If you did this via e-bir, no need. I still print all of these though so I have records.

Hi Kimberley Reyes.

Thanks for this tutorial.

Regarding the section, “Here’s a sample payment I did when I had to pay the yearly P500 registration fee:”

Since the annual registration fee covers the entire year, shouldn’t “return period” be the date of the end of that period? Thus it should be 123119, not 011419 as in your first photo.

Regards.

Hi JM, if you’re paying this 2020, it should be 12312019.

Good day what is the tax payers branch code for the RF? Thanks

Hi Kirby, if you don’t have multiple branches, just write five zeroes for the branch code (00000).

Is branch code the RDO code?

Hi Aimee. Those are two different things. RDO code is the RDO where you’re registered. The branch code refers to the branches of the business. I believe this applies to businesses with different branches only.

I already processed the payment. Nov 15 kase deadline, and Nov 14 ako nag bayad ng 1701Q ko through GCASH. Nakalagay sa receipt, “This has been processed and your payment will be posted within 3 business days.” Eh kase tomorrow na yung deadline and ma post pa daw yung payment ko is within 3 business days pa. Ma pepenalty kaya ako nito?

Hello Erizia, please reach out to Gcash about this. 🙂

Hi, nagpenalty ka po? same issue here 🙁 just made my payment today.

which form can i sue i’f im going to pay 0619-e?

Hi Rica, sorry I’m not familiar with form 0619-e.

hind k n ba pupunta na BIR office for the returns para mareciv nila after payment? hassle pa din. nakaiwas k nga ng BANGKO pila sa BIR office pipila k naman

If you submit electronically, you don’t need to go to BIR.

What if mali ang naitype sa GCASH sa date ng return period ng quarterly percentage tax ? Like for example October 25, 2019 ang na type sa return period instead of September 30, 2019 ? Tapos na sent na yun payment at may payment acknowledgement email na si Gcash? May penalty po ba ako? Salamat.

Hello Gina, maganda niyan pumunta ka sa RD mo to confirm. Do it ASAP para malaman mo na agad kung may penalty.

Good day po!

What if ang branch code po ay 53B? Di po makapag-input ng B. Okay lang po ba na 53 na lang ang ilagay? Thank you po for the reply

Hindi po ba RDO ang 53B?